Last Updated on May 14, 2024 by Silvy

Alibaba’s Revenue Rises 7% as Company Refocuses on Core Businesses

- Shares slide as core business manage just single-digit growth

- Alibaba is in the middle of a longer-term turnaround effort

Alibaba Group Holding Ltd. reported a 6.6% increase in revenue for the quarter ended March 2024, driven by modest growth in its core e-commerce and cloud businesses. The company’s revenue reached 221.9 billion yuan ($30.7 billion), slightly above analysts’ estimates of 219.8 billion yuan. However, Alibaba’s net income plunged 86% due to losses from its publicly traded holdings, missing expectations.

Turnaround Efforts Amid Challenges

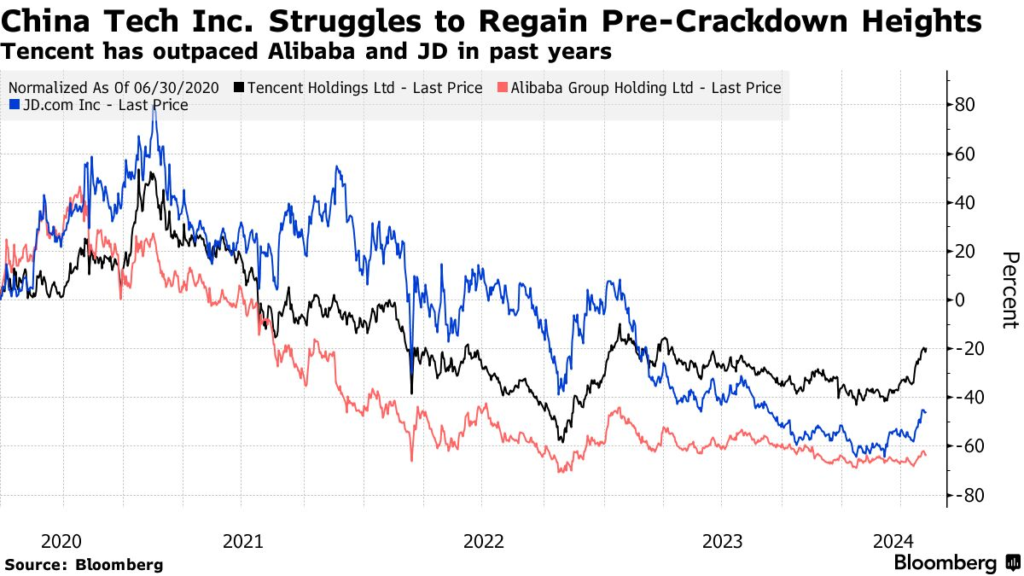

The modest revenue growth and steep decline in net income highlight the challenges Alibaba faces as it navigates a choppy economic recovery and intense competition from rivals like PDD Holdings Inc. and ByteDance Ltd.

The company is in the midst of a turnaround effort led by CEO Eddie Wu and Chairman Joe Tsai, who took over from Daniel Zhang in September 2023.Wu and Tsai have scrapped major initiatives conceived under Zhang, such as the planned IPO of logistics arm Cainiao and the $11 billion cloud unit.

Instead, they are refocusing on improving the customer experience and fostering innovation in Alibaba’s core businesses.

Core Businesses Show Modest Growth

Alibaba’s main Chinese commerce division saw revenue growth of just 4%, while the cloud arm grew by 3%. To revive growth, the company has taken steps like enhancing customer service, expanding product offerings, and introducing features like easy returns.

In the cloud business, Alibaba is slashing prices to regain clients from state-backed companies and rivals like Huawei Technologies Co.

Dividend Announcement and Asset Divestments

Alibaba announced a $4 billion dividend for the fiscal year, potentially boosting investor confidence. The company is also divesting non-core assets, such as stakes in streaming platform Bilibili and electric vehicle maker XPeng Inc., to raise capital. While Alibaba’s results reflect the challenges it faces, the company’s efforts to refocus on its core businesses and improve customer experience could position it for future growth as the Chinese economy recovers.

Sources:

https://data.alibabagroup.com/ecms-files/1532295521/fceda7a9-57ee-423d-a357-147f796a95e8.pdf

2 https://www.businesswire.com/news/home/20210513005533/en/Alibaba-Group-Announces-March-Quarter-and-Full-Fiscal-Year-2021-Results

3 https://data.alibabagroup.com/ecms-files/1532295521/50e3fa14-5992-49ad-8ca3-f56c147b227d/Alibaba%20Group%20Announces%20June%20Quarter%202023%20Results.pdf

4 http://static.alibabagroup.com/reports/fy2022/ar/ebook/en/index.html

5 https://data.alibabagroup.com/ecms-files/1532295521/4ef4c5fc-f661-4cfd-8898-6db990c8c232/Alibaba%20Group%20Announces%20September%20Quarter%202023%20Results.pdf